arkansas estate tax statute

Search the Arkansas Code for laws and statutes. The average Arkansas property tax bill adds up to 890.

Arkansas Code Of 1987 Annotated Lexisnexis Store

AR4FID Fiduciary Interest and Dividends.

. However the figure fluctuates from county. Additional taxes and fees may be charged by the city or town fire or school district for special measures or. The fact that Arkansas has neither an inheritance tax nor an estate tax does not mean all Arkansans are exempt when it comes to tax consequences as part of an estate plan.

B Since neither the commission nor the department pursuant to Arkansas Constitution Article 16 5 are required to pay real or personal property taxes on real estate and tangible personal. Online payments are available for most counties. Locate your county on the map or select from the drop-down menu to find ways to pay your personal property tax.

B Since neither the commission nor the department pursuant to Arkansas Constitution Article 16 5 are required to pay real or personal property taxes on real estate and tangible personal. Arkansas Property and Real Estate Laws. Welcome to FindLaws section on Arkansas property and real estate laws covering statutes that govern the landlordtenant relationship homestead.

The Real Property Transfer Tax is levied on each deed instrument or writing by which any lands tenements or other realty sold shall be granted assigned transferred or. Arkansas Code Search Laws and Statutes. Want to avoid paying a.

The county determines property taxes in Arkansas not the state. AR K-1FE - Arkansas Income Tax Owners Share of Income Deductions Cridits Etc. Act 141 of Arkansas 91 st General Assembly exempts Military Retired Pay from Arkansas State Income Taxes.

Learn about arkansas income property and sales tax rates to estimate what youll pay on your 2021 tax return. The average homeowner pays 640 for every 1000 of home value in property taxes. Does arkansas have an inheritance tax or an estate tax.

While property taxes in Arkansas are primarily a local function there are good reasons to think of some real property taxes as state-level taxes even though legally they are. Arkansas military retirement pay is exempt from state taxes.

How Is Arkansas Probate Law Different

Arkansas Children And Family Laws Annotated Lexisnexis Store

Can The State Of Arkansas Tax My Inheritance Milligan Law Offices

Arkansas Military And Veterans Benefits The Official Army Benefits Website

Filing An Arkansas State Tax Return Things To Know Credit Karma

Arkansas Inheritance Laws What You Should Know

Free Arkansas General Warranty Deed Form Pdf Word Eforms

Tax Legislation For 2022 Arkansas House Of Representatives

The Ultimate Guide To Arkansas Real Estate Taxes

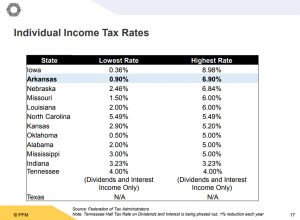

It S All About The Context A Closer Look At Arkansas S Income Tax Arkansas Advocates For Children And Families Aacf

Arkansas Estate Tax Everything You Need To Know Smartasset

Property Tax Calculator Estimator For Real Estate And Homes

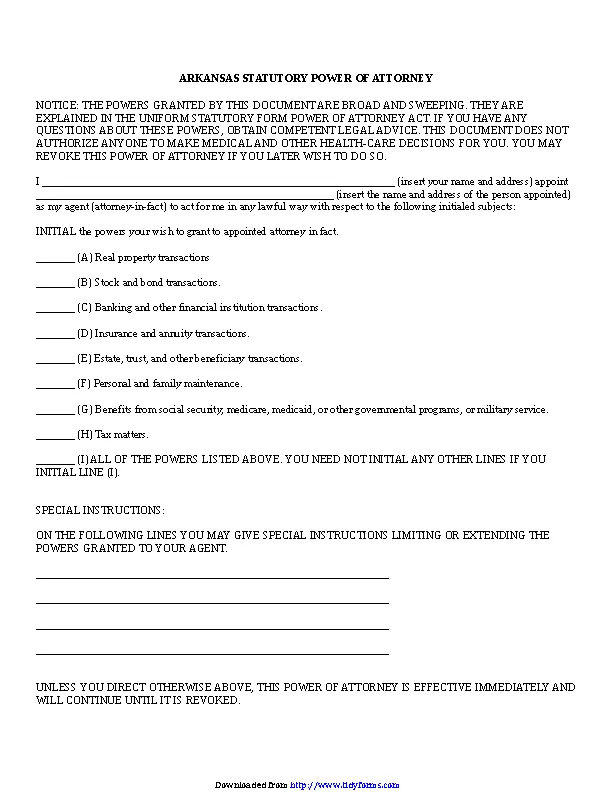

Arkansas Statutory Power Of Attorney Form Pdfsimpli

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Create A Living Trust In Arkansas Legalzoom

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

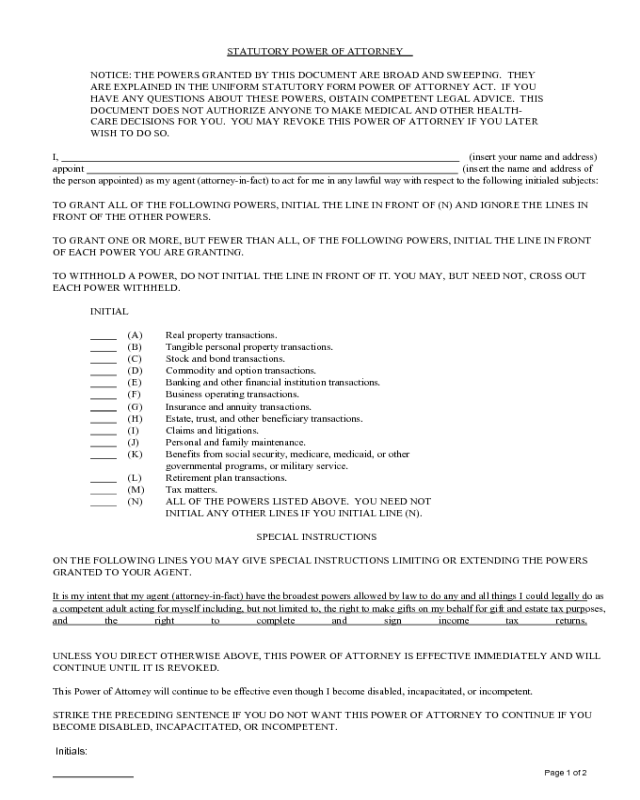

Statutory Power Of Attorney Arkansas Edit Fill Sign Online Handypdf