year end accounts extension

Is It Time to Buy the 5 Worst-Performing Value Stocks of 2021. Employees leaving state service cannot pre-pay or have a pre-tax deduction lump sum taken from their last check for the balance of their current year plan contribution.

Understanding Profitability Ag Decision Maker

All claims must be filed by October 15.

. Some big stocks are poised to end the year as losers but the value categorys extended stretch of underperformance may be coming to. Do Appetite Suppressants Work. Claims can be filed with dates of service through the end of the 25 month extension.

Flexible Spending Accounts are sometimes called Flexible Spending Arrangements. These accounts provide enormous tax benefits--tax deductions for plan contributions and tax deferral on investment earnings until retirement. This will send an e-mail to reset your password on all Cengage accounts.

All claims must be filed by October 15. How much you can contribute each year depends on the type of plan you have and the amount of your net. Chelsea defender Thiago Silva has signed a one-year contract extension with the club until the end of the 202223 season.

For calendar years 2016 and subsequent at the end of the day April 15th of the year following the calendar year for which accounts must be reported if a complete and accurate FBAR is not filed by October 15th the automatic extended due date announced by FinCEN. We would like to show you a description here but the site wont allow us. Add To Cart Best Seller.

Learn more about FSAs from the IRS including allowed expense. You get 25 more months to spend the left over money. As a result Im about 2 months behind where I usually am in a pre-Covid year.

Silva joined Chelsea in the summer of 2020 following the end of his Paris. Explore some of our most popular vitamin and supplement products. Support for the bodys natural immune defenses.

50 mg 90 vegetarian capsules. Need some help with those New Years resolutions. That means my 2021 filing period has been one month less than pre-Covid years and two months less than we had for 2020.

The good news is that many of the payroll software options available offer tax and year-end payroll support and many of these forms can be filed online. If you need more time to file your accounts you may be able to apply for a 3-month extension. If money is left at the end of the year the employer can offer one of two options not both.

Businesses need to file many forms starting with W-2s W-3s 1099-NEC Form 1096 Form 940 Form 941 Form 944 Form 1095-B and more. That meant I didnt start 2020-21 accounts until mid-March 2021 Im talking about early year ends which is one month later than in a pre-Covid year. Companies that are eligible and cite issues.

There are an array of retirement accounts available--solo 401ks IRAs SEP-IRAs Simple IRAs and Keogh plans. You can carry over up to 500 to spend the next plan year. Want to keep your appetite in check.

Understanding Profitability Ag Decision Maker

Oct 15 Fbar Extension Deadline Nears For Foreign Bank And Financial Account Holders Internal Revenue Service Financial Accounting

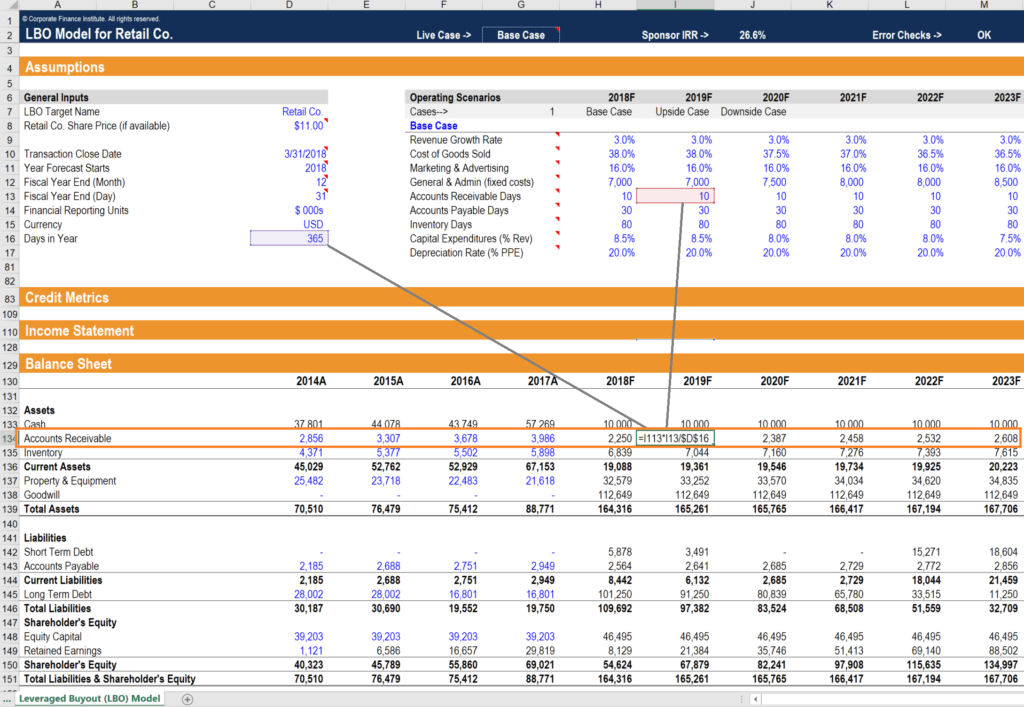

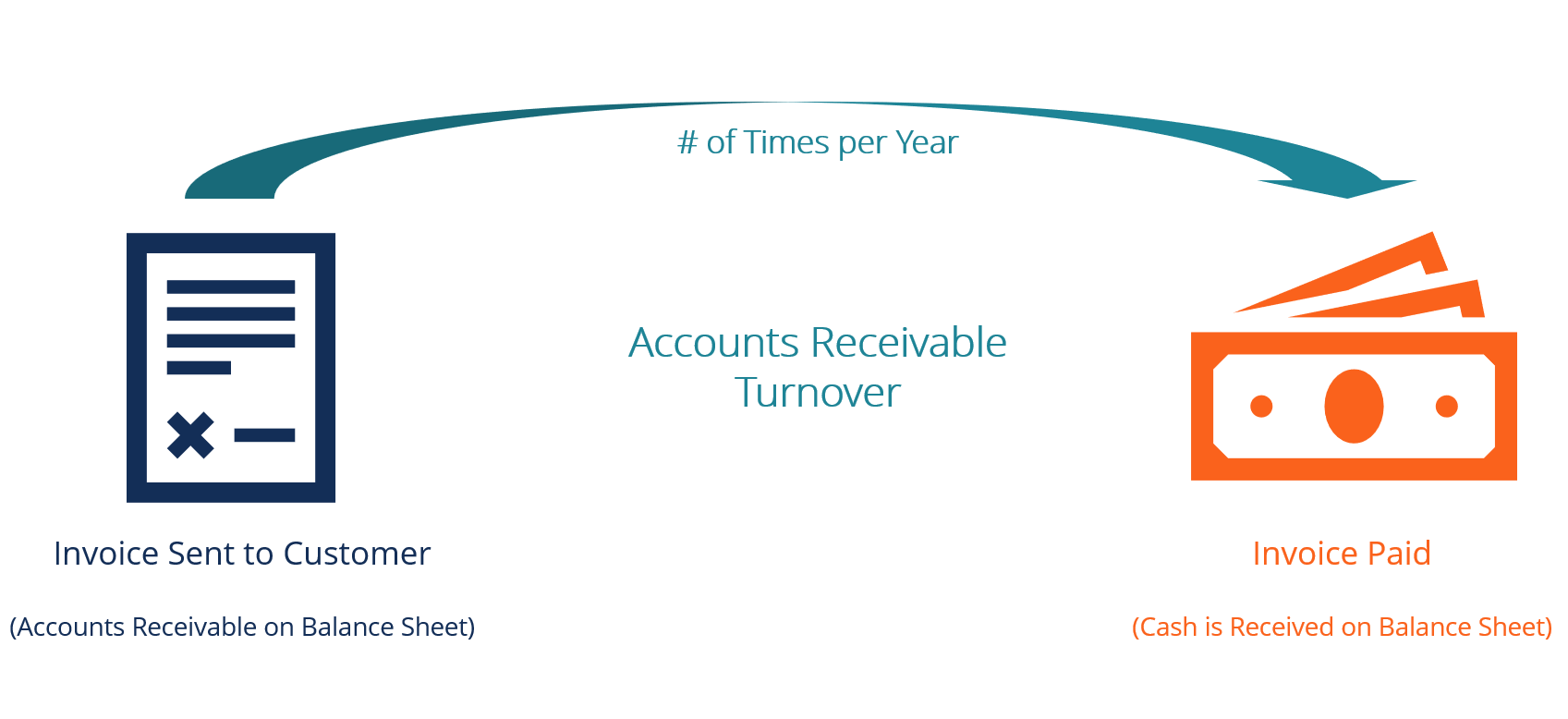

Accounts Receivable Turnover Ratio Formula Examples

Accounts Receivable Turnover Ratio Formula Examples

Accounting Closing Day 81 Best Messages Quotes And Greetings Messages Accounting Classes Quick Books Accounting

Understanding Profitability Ag Decision Maker

Accounts Receivable Turnover Ratio Formula Examples

Extension Of Due Date Of Filing Of A Cs To Charity Commissioner Of Maharashtra